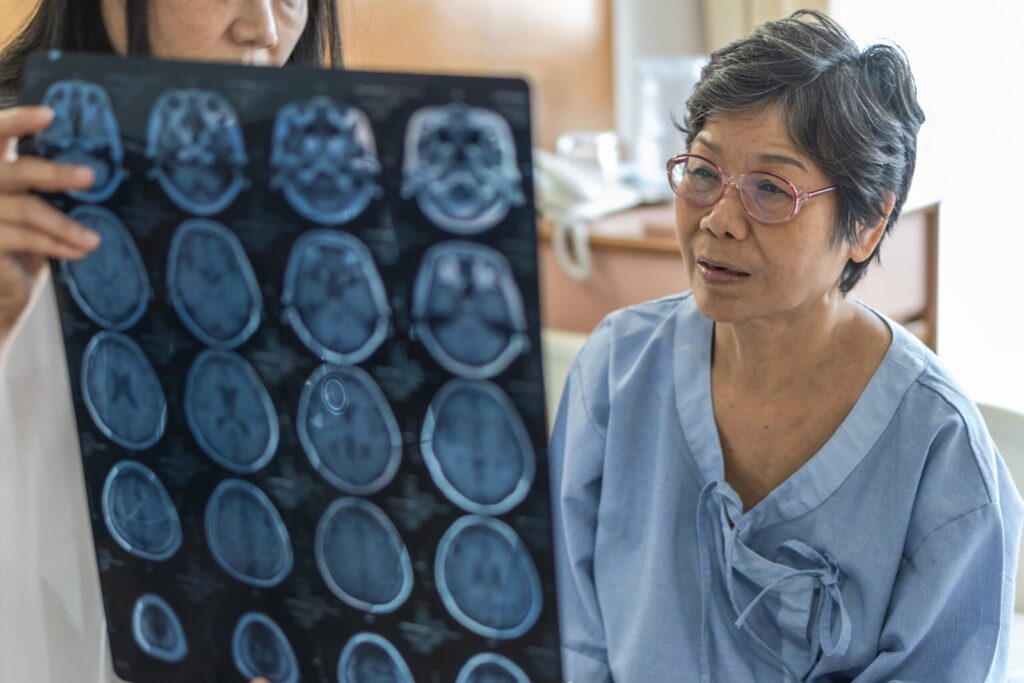

Have You Suffered from a Traumatic Brain Injury?

Traumatic brain injuries, also known as TBI, are life-altering injuries that can have negative effects that ripple well into the future.

Traumatic brain injuries can be the result of a violent blow to the head or a jolt to the head, neck, or body. An object traveling through the brain tissue, such as a bullet or piece of broken skull, can also cause a traumatic brain injury.

The most common causes of TBI are falls, car crashes, sporting injuries, and being struck in the head by an object.

Car accidents are among the leading causes of TBI and the most likely reason you would be dealing with an insurance claim regarding a brain injury.

We pay hundreds and even thousands of dollars to our insurance providers throughout our lives with the expectation that they will care for us when it comes time to make a claim. But what should you do if you believe your provider is acting in bad faith? What North Carolina laws protect victims when insurance providers act in a way that is against your best interest?

Why Would Your Insurance Deny Your Claim?

While insurance companies put on the friendly face of your neighborhood helper or run comedic ads while your favorite team is playing, it is important to remember that these businesses are not your friends. They are businesses, and a business’s primary goal is to make money.

In order for an insurance company to remain profitable, they must take in more money than they pay out. This seems obvious: you have a basic understanding of how a business works, and you pay this company, hoping you will never have to use their service. However, now that you are filing a claim, the friendly smile is gone, and so are the jokes. Now that you are in pain and need help, you might be left wondering why your particular situation doesn’t seem worthy of an insurance payout.

Your insurance may not even outright deny your claim. Perhaps they simply chose to pay out an amount that is far below what you expected it to be. This might not even be for nefarious reasons. Insurance providers may offer a lesser payout because they are lacking the necessary information. Perhaps they valued the damages to you and your property differently than you.

If you claimed pain and suffering but did not complete a mental health evaluation and include it in your claim, then your provider will likely not pay for it.

Worse, your provider may feel that your TBI was not a result of the accident your claim says it is. Your provider may question if you have already had the injury, meaning they can pay less or avoid paying you at all for this claim.

These examples alone are reason enough to work with a personal injury lawyer. A well-trained lawyer can ensure that the insurance companies have all of the information needed in order to make a well-informed decision when considering your claim. Hiring an attorney sooner rather than later can also save time and heartache during an already difficult situation.

Your insurance provider won’t be able to hide behind “missing information” as easily when a personal injury attorney has your back and is helping ensure that all the necessary information has already been collected and submitted.

But what if that still isn’t enough? What if your provider is downright acting in bad faith?

How Do North Carolina Laws Affect Insurance Bad Faith?

Federal laws dictate that insurance companies owe a duty of good faith and fair dealing to their insured customers. This means that providers are contractually required to work in good faith.

North Carolina has its own laws regarding contracts, which are called the North Carolina Unfair and Deceptive Practices Act. This law allows a plaintiff to recover extra-contractual damages, meaning you can receive both the settlement that is the subject of the original claim as well as punitive damages.

This extra layer of accountability exists to deter insurance companies, as well as other companies that enter into contracts, from acting in bad faith.

This means that if you file an insurance claim for your TBI and the insurance company acts in bad faith, denying your claim or offering you far less than what you are owed, then you have the opportunity to sue them for not only what the original settlement should have been, but also for punitive damages.

How Can You Spot Bad Faith?

There are a few ways you can spot bad faith, some obvious, some harder to see:

- It takes an unreasonable amount of time to investigate your claim.

- Your information or file is misplaced.

- You are threatened.

- You are offered an amount that is too low, and they refuse to negotiate.

- They stop all forms of communication.

- They make you jump through unnecessary hoops.

- Denies your claim without explanation.

Do You Need an Attorney to Fight Bad Faith Insurance?

Your insurance agency has a team of lawyers ready. They are used to doing what they can to straddle the line of legal, making sure they keep as much of your money as possible. It is important to work with a personal injury attorney, even when the stakes aren’t as high as a TBI.

Call 919-277-0150 to schedule your free consultation with the compassionate team of O’Malley Tunstall PC. Don’t take on large companies alone. Work with our experienced team to ensure that this company acts in good faith, whether they want to or not.